How To Get A Lower Interest Rate On Student Loans

How to Lower Your Student Loan Involvement Rate

Individual lenders apply credit indicators to determine the interest rate they'll offer. Monitor and manage these indicators to improve your offers and earn the lowest rates.

At this time, there are no interest-gratis student loans bachelor. Be sure to seek out alternate forms of teaching funding, such equally scholarships, before using loans. Qualify for more scholarships with a high SAT score. Virtually anyone tin can improve their score with an SAT prep course.

Lower Your Involvement Charge per unit

Whatever time your financial situation improves, yous may take an opportunity to refinance your student loans for a lower interest rate. Completing a degree, an improved income or credit score, and a new job or promotion can all influence the interest rate offers you lot receive from lenders.

The better your fiscal situation, the more likely lenders are to offer yous a depression interest charge per unit. There is no limit to the number of times you lot can refinance your loans, so whatever time you improve to your financial wellness may be a good time to consider refinancing.

Use All Charge per unit Reductions

Identify every rate reduction your lender or loan servicer offers. For instance, a fairly common offer is an interest rate reduction forth with enrollment in automatic payments. Some lenders offering rate reductions for consecutive on-fourth dimension payments or for submitting additional personal or financial documentation (a recent pay stub, a transcript, etc.).

Such reductions are typically 0.25% to 0.50% each. Lenders may allow multiple reductions, meaning borrowers tin earn total reductions up to one.50% (or as high as 2.75%, merely this requires refinancing with a loan that is non considered educational for revenue enhancement purposes).

Better Credit Score

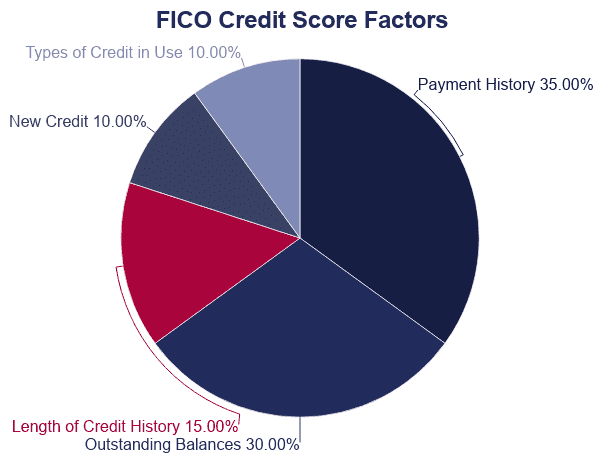

Your credit score and credit history reflect your borrowing habits. If your score has recently improved, you may authorize for a lower involvement rate. Activities that tin can improve your credit score include repaid debts, untapped credit lines, and prompt payments over the long term.

Former activity eventually disappears from your report, and then financial experts and government administrators recommend checking your credit report at least once per year. Every American citizen is entitled to at least one free credit report annually.

Complete a Degree

Educatee loan refinance programs use your highest level of instruction to decide your loan eligibility. Borrowers with higher degrees have more earning potential. Lenders may too view a completed degree as a demonstration of long-term commitment and responsibility.

Borrowers with more advanced degrees are generally approved for larger loans at lower interest rates than borrowers with undergraduate degrees or no degree at all. Among the refinance lenders nosotros've researched, fifty% require at least an acquaintance's degree in order to qualify for refinancing. Those that allow not-graduate refinancing accuse the highest interest rates to these borrowers.

Change in Income

Since your income directly relates to your power to repay your loan, this is a significant factor that student loan refinance lenders to make up one's mind your interest rate. Your income can influence your charge per unit in multiple ways.

Lenders calculate your debt-to-income ratio, which gives them an idea of how much of your income you will have to spend on loan payments. If your monthly loan payment represents a relatively depression percentage of your income, you are more probable to authorize for a lower interest charge per unit. Generally, if your monthly payment is the equivalent of 50% or more of your income, you lot will not be approved for a refinance loan.

If your income has become more reliable – for example, if you've gone from "gig" piece of work to salaried employment – lenders will be more than probable to offer you a lower involvement rate as they volition consider you a more reliable source of payment.

New Task or Promotion

An improved income is often the added benefit of a promotion. Even if it doesn't include an income boost, a new job or a promotion demonstrates your ability to maintain steady, long-term employment.

Such indications of career advancement suggest greater future earning potential. If your income is low-end just you work in an industry or position with a insufficiently loftier potential income, you may qualify for a lower involvement rate.

Utilize a Co-Signer

Adding a co-signer to your loan may reduce your interest charge per unit whether yous take good credit or not. Co-signers are mostly spouses, parents, or other family members. Any qualifying person tin co-sign your loan, however.

A co-signer shares the responsibility of repaying your debt. Should your loan enter delinquency or default, your co-signer also faces financial consequences.

In many cases, refinance lenders will allow you to release a co-signer from the loan contract after a sure number of sequent qualifying payments. Releasing a co-signer totally relieves that person from any responsibleness regarding your loan.

Sources

- Consumer Finance Protection Agency (CFPB), Debt-to-income Computer

- CFPB, Consumer Credit Trends

- Federal Merchandise Commission, Consumer Information: Understanding Your Credit

- MyFICO, How Scores Are Calculated

- The Academy of Kansas Office of the Vice Provost for Educatee Affairs, Student Money Management Services

- U.South. Department of Teaching National Middle for Teaching Statistics, The Condition of Teaching

- MPower Financing, Loan Repayment Examples

How To Get A Lower Interest Rate On Student Loans,

Source: https://educationdata.org/how-to-lower-student-loan-interest-rate

Posted by: bergerfaids2000.blogspot.com

0 Response to "How To Get A Lower Interest Rate On Student Loans"

Post a Comment